Bad tax advice is multiplying on TikTok

TKFFF · 2024-04-09 17:56

FILE - The TikTok Inc. building is seen in Culver City, Calif., Friday, March 17, 2023. Four of the largest school boards in the Canadian province of Ontario launched lawsuits Thursday, March 28, 2024, against TikTok, Meta

Taking an affordable vacation is easy, accountant Krystal Todd suggests in her TikTok videos: Schedule some meetings, call it a business trip and deduct it from your taxes.

A certified public accountant in Miami, Todd has nearly 240,000 followers on TikTok and 68,000 on Instagram. She has paid partnerships with tax filing and financial services firms Intuit and TaxSlayer.

But offline, she says viewers might need more information than the tax tips in her videos.

“I’m a CPA, but I’m not your CPA,” she said of her social media content. “It’s financial education, not financial advice.”

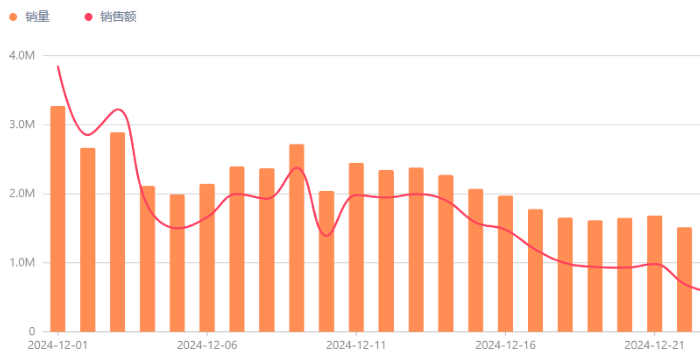

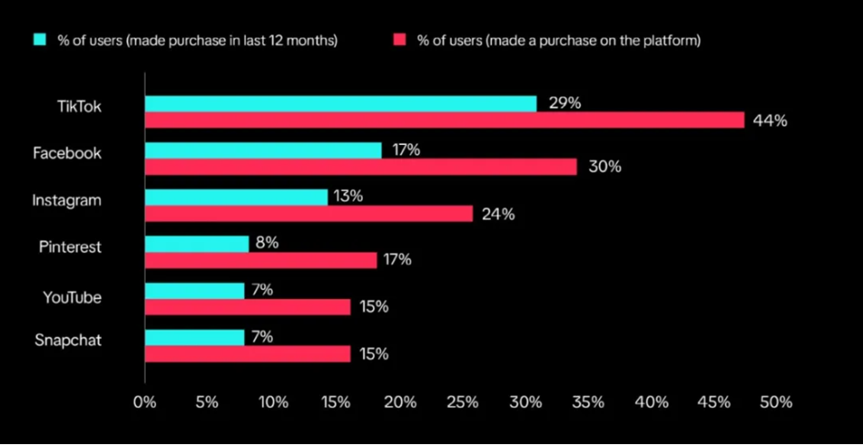

As the April 15 filing deadline approaches, aggressive tax advice is booming online, especially on the popular video sharing app TikTok. The Internal Revenue Service, though, says a lot of the advice is dubious, exposing unwitting taxpayers to potential fines if they try to carry it out. Bad tax advice has been a problem for generations, but it spreads far more easily on social media than it did in the pre-internet days.

The tips that pop up on TikTok and on Instagram and Facebook, both owned by Meta, make splashy claims that promise big returns. One influencer, Karlton Dennis, says to buy short-term rental properties that lose money on paper, and use that to offset income from your full-time job. Another, Candy Valentino, tells followers to hire their children as employees and deduct some of their housing costs as a business expense - and if their accountant warns that could cause an audit, their accountant is wrong. Still others tell hundreds of thousands of followers to buy 6,000-pound vehicles, then write off the sticker price, maintenance and fuel.

Some creators’ videos go much further, urging people not to pay taxes at all: “Taxes are a scam.” “There’s no law to pay taxes.” “Paying taxes is voluntary.” All of those claims are false.

A TikTok spokesperson said the company removes what it deems to be scams or fraud from its platform, and promotes “best practices” when engaging with online financial content. The site prohibits content that involves the “coordination, facilitation, or instructions on how to carry out scams.” And TikTok’s financial decisions guide tells users to seek “credible sources to cross-check financial guidance.”

Meta declined a request to comment.

In reality, taxpayers can’t deduct salaries they pay their children unless the children truly are gainfully employed, and they can’t deduct the full cost of a fancy new vehicle unless the car is used to run a business, not for personal use. Deducting business trips from your taxes can be legal - but it’s more complicated than just scheduling a meeting during your vacation, and experts suggest keeping business transactions and personal transactions separate to avoid red flags for audits.

And taxes are legal - and not at all voluntary.

“This is not a new phenomenon in any way. The challenge is, on the social media platforms, that the availability of these messages is so much broader,” one recent former top IRS official said. The person spoke on the condition of anonymity to discuss nonpublic agency policy. “Twenty or 30 years ago, this was something your brother-in-law handed around in a shady pamphlet on the weekends.”

Congress and the Biden administration are already concerned about TikTok for other reasons: Worries over Chinese access to the app’s user data led the House in March to vote to force its parent company ByteDance to sell the site to U.S. owners, lest it face a nationwide ban. The Senate is considering the measure. (Tax misinformation spreads on U.S.-based apps, too.)

Many of the influencers posting tax tip videos post a range of advice, much of which is sounder and less aggressive than the most eye-catching videos about big deductions. Several of them made clear in interviews that they do understand the nuances of tax law. The videos serve mostly to draw attention to their content - and to help promote the idea that their financial advice, in general, will lead to riches. Many refer viewers to other products - including stock tips, books and online courses - after offering questionable tax tips.

“I bought a $70,000 truck late last year to save more than $21,000 on my taxes,” Mike Poarch said in a video promoting what he calls a “tax hack.” The purchase, he said, “now allows me to write off all of my gas, which is about $70 a week, plus my insurance, which is like $350 a month, plus all of the maintenance and all of the upgrades.”

In an interview, Poarch acknowledged that only business use of the vehicle is deductible, not personal use: “Sometimes these videos make it appear a little more rosy than it may actually be, but that’s to help with virality.”

Todd said she thinks of her TikTok videos as educational tools, especially for young women of color like her. She explains in her videos how someone should fill out tax forms when starting a new job, for example. She said she tries to give people a more positive and nuanced outlook by talking about reasons it might be good not to get a refund, and how taxes shape society in beneficial ways. Like many TikTokers, Todd said she believes the advice she gives her in-person, paying clients as a certified professional accountant is held to a higher standard for accuracy than the advice she gives online.

Intuit in a statement said its collaboration with Todd was part of the company’s “efforts to provide career opportunities for bookkeepers, and is not an endorsement of other content.” It urged consumers to “be mindful of tax and financial advice on social media.” Representatives for TaxSlayer did not respond to requests for comment.

Todd removed videos promoting TaxSlayer products and links to TaxSlayer discounts from her social media pages and personal website after an interview and after The Washington Post asked TaxSlayer about her affiliation with the company.

Frequently, influencers said their videos were deliberately flattening important context around tax law.

In one recent clip, Will Myers, who makes videos for his 421,700 TikTok followers and 173,000 Instagram followers under the name Money Man Myers, said he helped one client swing their tax return from owing the IRS more than $146,000 to getting a $16,000 refund, using strategies such as hiring the client’s children for their business.

When a reporter asked - really? - Myers conceded, “They have to do real work. The job has to match their age. You can’t say your 4-year-old is driving.” And he showed his detailed knowledge of tax law, even citing the case number of a tax court decision on the question of hiring a child.

Dennis did not respond to requests to comment on his videos, and Valentino said she would only participate in an interview if The Post paid her for her time, which is against standard journalistic ethics.

Thomas Fattorusso Jr., the special agent in charge of the IRS’s criminal investigations division for New York, said his department is aware of social media trends - he mentioned the common videos about hiring children and buying trucks, specifically, in an interview, but declined to discuss individual investigations.

He noted that social media influencers might not be directly profiting from an incorrect tax return generated by a person who listens to their online tips in the way that a tax preparer who lies on a client’s tax return directly profits. Influencers aren’t charging clients to submit returns based on their bad advice. But many do make money on their videos, whether directly on the social media platform or by using the platform to sell a product like a course on financial strategies.

Even though the influencers aren’t acting as the tax preparer or adviser for followers on social media, advice that they give could in theory make them a “promoter” in the eyes of the IRS. Fattorusso described a “promoter” as someone who knowingly disseminates a tax fraud scheme, which means they could come under criminal investigation, he said: “You are promoting this. There’s a willful intent to what you’re doing in telling people they can do this when you know they can’t and it’s illegal.”

Fattorusso’s office pointed to other tax promoter cases as examples, though none of those defendants’ activities were solely on social media.

Making a case against an influencer just because of bad tax advice in videos would be immensely difficult, said Nina Olson, who served as the National Taxpayer Advocate, the IRS’s internal watchdog, from 2001 to 2019. In that role, she campaigned for Congress to expand the IRS’s authority to regulate tax preparers and others who offer tax advice.

IRS investigators would have to identify a similar problem on a large number of tax returns, audit those taxpayers and trace the deficiencies of the tax filings to the same online influencer.

“You can’t stop people from saying stupid things,” Olson said. “It’s when they’re monetizing stupid things and you can make a tie to someone else’s act, relying on what they said.”

And some TikTok tax tippers have begun hedging their language to avoid legal pitfalls, said Caroline Bruckner, who studies tax administration and financial literacy at American University’s Kogod Tax Policy Center. Adding phrases like “Take a look at” or “In my opinion” ahead of sharing questionable tax advice could insulate content creators from legal consequences, she said.

Maryland accountant Nick Krop, 30, has been making videos since 2021 in which he frequently shows a snippet of another social media creator’s tax advice, then says why it’s wrong. Reacting to a video that advised putting assets into a trust to avoid taxes, Krop marveled, “It’s not true, a work of fiction, a complete fabrication. … A trust is not a magical entity that will shield you from taxes.” On a video that claimed whole life insurance could be used to avoid taxes, Krop commented, “Good rule of thumb: if it was that easy to reduce your taxable income to nothing, everyone would be doing that.”

He said even some of his own clients who work from home have asked if they can write off new cars - which seems inherently dubious.

Krop, like every TikTok creator interviewed for this story, said he doesn’t think the government should police what anyone says on social media about taxes. But he does think TikTok should put its thumb on the scale to make sure users see correct tax advice more often than incorrect: “It would be nice if TikTok would elevate those people who are trying to correct the record.”

[ad]

FILE - The TikTok Inc. building is seen in Culver City, Calif., Friday, March 17, 2023. Four of the largest school boards in the Canadian province of Ontario launched lawsuits Thursday, March 28, 2024, against TikTok, Meta

Taking an affordable vacation is easy, accountant Krystal Todd suggests in her TikTok videos: Schedule some meetings, call it a business trip and deduct it from your taxes.

A certified public accountant in Miami, Todd has nearly 240,000 followers on TikTok and 68,000 on Instagram. She has paid partnerships with tax filing and financial services firms Intuit and TaxSlayer.

But offline, she says viewers might need more information than the tax tips in her videos.

“I’m a CPA, but I’m not your CPA,” she said of her social media content. “It’s financial education, not financial advice.”

As the April 15 filing deadline approaches, aggressive tax advice is booming online, especially on the popular video sharing app TikTok. The Internal Revenue Service, though, says a lot of the advice is dubious, exposing unwitting taxpayers to potential fines if they try to carry it out. Bad tax advice has been a problem for generations, but it spreads far more easily on social media than it did in the pre-internet days.

The tips that pop up on TikTok and on Instagram and Facebook, both owned by Meta, make splashy claims that promise big returns. One influencer, Karlton Dennis, says to buy short-term rental properties that lose money on paper, and use that to offset income from your full-time job. Another, Candy Valentino, tells followers to hire their children as employees and deduct some of their housing costs as a business expense - and if their accountant warns that could cause an audit, their accountant is wrong. Still others tell hundreds of thousands of followers to buy 6,000-pound vehicles, then write off the sticker price, maintenance and fuel.

Some creators’ videos go much further, urging people not to pay taxes at all: “Taxes are a scam.” “There’s no law to pay taxes.” “Paying taxes is voluntary.” All of those claims are false.

A TikTok spokesperson said the company removes what it deems to be scams or fraud from its platform, and promotes “best practices” when engaging with online financial content. The site prohibits content that involves the “coordination, facilitation, or instructions on how to carry out scams.” And TikTok’s financial decisions guide tells users to seek “credible sources to cross-check financial guidance.”

Meta declined a request to comment.

In reality, taxpayers can’t deduct salaries they pay their children unless the children truly are gainfully employed, and they can’t deduct the full cost of a fancy new vehicle unless the car is used to run a business, not for personal use. Deducting business trips from your taxes can be legal - but it’s more complicated than just scheduling a meeting during your vacation, and experts suggest keeping business transactions and personal transactions separate to avoid red flags for audits.

And taxes are legal - and not at all voluntary.

“This is not a new phenomenon in any way. The challenge is, on the social media platforms, that the availability of these messages is so much broader,” one recent former top IRS official said. The person spoke on the condition of anonymity to discuss nonpublic agency policy. “Twenty or 30 years ago, this was something your brother-in-law handed around in a shady pamphlet on the weekends.”

Congress and the Biden administration are already concerned about TikTok for other reasons: Worries over Chinese access to the app’s user data led the House in March to vote to force its parent company ByteDance to sell the site to U.S. owners, lest it face a nationwide ban. The Senate is considering the measure. (Tax misinformation spreads on U.S.-based apps, too.)

Many of the influencers posting tax tip videos post a range of advice, much of which is sounder and less aggressive than the most eye-catching videos about big deductions. Several of them made clear in interviews that they do understand the nuances of tax law. The videos serve mostly to draw attention to their content - and to help promote the idea that their financial advice, in general, will lead to riches. Many refer viewers to other products - including stock tips, books and online courses - after offering questionable tax tips.

“I bought a $70,000 truck late last year to save more than $21,000 on my taxes,” Mike Poarch said in a video promoting what he calls a “tax hack.” The purchase, he said, “now allows me to write off all of my gas, which is about $70 a week, plus my insurance, which is like $350 a month, plus all of the maintenance and all of the upgrades.”

In an interview, Poarch acknowledged that only business use of the vehicle is deductible, not personal use: “Sometimes these videos make it appear a little more rosy than it may actually be, but that’s to help with virality.”

Todd said she thinks of her TikTok videos as educational tools, especially for young women of color like her. She explains in her videos how someone should fill out tax forms when starting a new job, for example. She said she tries to give people a more positive and nuanced outlook by talking about reasons it might be good not to get a refund, and how taxes shape society in beneficial ways. Like many TikTokers, Todd said she believes the advice she gives her in-person, paying clients as a certified professional accountant is held to a higher standard for accuracy than the advice she gives online.

Intuit in a statement said its collaboration with Todd was part of the company’s “efforts to provide career opportunities for bookkeepers, and is not an endorsement of other content.” It urged consumers to “be mindful of tax and financial advice on social media.” Representatives for TaxSlayer did not respond to requests for comment.

Todd removed videos promoting TaxSlayer products and links to TaxSlayer discounts from her social media pages and personal website after an interview and after The Washington Post asked TaxSlayer about her affiliation with the company.

Frequently, influencers said their videos were deliberately flattening important context around tax law.

In one recent clip, Will Myers, who makes videos for his 421,700 TikTok followers and 173,000 Instagram followers under the name Money Man Myers, said he helped one client swing their tax return from owing the IRS more than $146,000 to getting a $16,000 refund, using strategies such as hiring the client’s children for their business.

When a reporter asked - really? - Myers conceded, “They have to do real work. The job has to match their age. You can’t say your 4-year-old is driving.” And he showed his detailed knowledge of tax law, even citing the case number of a tax court decision on the question of hiring a child.

Dennis did not respond to requests to comment on his videos, and Valentino said she would only participate in an interview if The Post paid her for her time, which is against standard journalistic ethics.

Thomas Fattorusso Jr., the special agent in charge of the IRS’s criminal investigations division for New York, said his department is aware of social media trends - he mentioned the common videos about hiring children and buying trucks, specifically, in an interview, but declined to discuss individual investigations.

He noted that social media influencers might not be directly profiting from an incorrect tax return generated by a person who listens to their online tips in the way that a tax preparer who lies on a client’s tax return directly profits. Influencers aren’t charging clients to submit returns based on their bad advice. But many do make money on their videos, whether directly on the social media platform or by using the platform to sell a product like a course on financial strategies.

Even though the influencers aren’t acting as the tax preparer or adviser for followers on social media, advice that they give could in theory make them a “promoter” in the eyes of the IRS. Fattorusso described a “promoter” as someone who knowingly disseminates a tax fraud scheme, which means they could come under criminal investigation, he said: “You are promoting this. There’s a willful intent to what you’re doing in telling people they can do this when you know they can’t and it’s illegal.”

Fattorusso’s office pointed to other tax promoter cases as examples, though none of those defendants’ activities were solely on social media.

Making a case against an influencer just because of bad tax advice in videos would be immensely difficult, said Nina Olson, who served as the National Taxpayer Advocate, the IRS’s internal watchdog, from 2001 to 2019. In that role, she campaigned for Congress to expand the IRS’s authority to regulate tax preparers and others who offer tax advice.

IRS investigators would have to identify a similar problem on a large number of tax returns, audit those taxpayers and trace the deficiencies of the tax filings to the same online influencer.

“You can’t stop people from saying stupid things,” Olson said. “It’s when they’re monetizing stupid things and you can make a tie to someone else’s act, relying on what they said.”

And some TikTok tax tippers have begun hedging their language to avoid legal pitfalls, said Caroline Bruckner, who studies tax administration and financial literacy at American University’s Kogod Tax Policy Center. Adding phrases like “Take a look at” or “In my opinion” ahead of sharing questionable tax advice could insulate content creators from legal consequences, she said.

Maryland accountant Nick Krop, 30, has been making videos since 2021 in which he frequently shows a snippet of another social media creator’s tax advice, then says why it’s wrong. Reacting to a video that advised putting assets into a trust to avoid taxes, Krop marveled, “It’s not true, a work of fiction, a complete fabrication. … A trust is not a magical entity that will shield you from taxes.” On a video that claimed whole life insurance could be used to avoid taxes, Krop commented, “Good rule of thumb: if it was that easy to reduce your taxable income to nothing, everyone would be doing that.”

He said even some of his own clients who work from home have asked if they can write off new cars - which seems inherently dubious.

Krop, like every TikTok creator interviewed for this story, said he doesn’t think the government should police what anyone says on social media about taxes. But he does think TikTok should put its thumb on the scale to make sure users see correct tax advice more often than incorrect: “It would be nice if TikTok would elevate those people who are trying to correct the record.”

[ad]

文章来源:Washington Post

TKFFF公众号

扫码关注领【TK运营地图】

TKFFF合作,请扫码联系!

文章来源: 文章该内容为作者观点,TKFFF仅提供信息存储空间服务,不代表TKFFF的观点或立场。版权归原作者所有,未经允许不得转载。对于因本网站图片、内容所引起的纠纷、损失等,TKFFF均不承担侵权行为的连带责任。如发现本站文章存在版权问题,请联系:1280199022@qq.com

分享给好友: