TikTok Shop Has Become a Huge Online Beauty Retailer as the Category Has Grown

Brands like GuruNanda, Lattafa, MySmile, Tarte Cosmetics and VeyesBeauty have seen huge sales growth on the app.

Leaders from Glossier, Shopify, Mastercard and more will take the stage at Brandweek to share what strategies set them apart and how they incorporate the most valued emerging trends. Register to join us this September 23–26 in Phoenix, Arizona.

Just nine months after hitting the market, TikTok’s in-application shopping tool is giving online beauty retailers a run for their money.

TikTok Shop is now the ninth-largest beauty and wellness ecommerce retailer in the U.S. market and the second-largest in the U.K. market, according to data from Dash Hudson and NielsenIQ. It has blown past competitors, changing the game for beauty brands that have figured out how to make the short-form video app’s algorithm work for them.

“[TikTok Shop] has surpassed most major department stores, most DTC (direct-to-consumer) players and the smaller beauty specialty retailers,” Anna Mayo, vice president of NielsenIQ’s beauty vertical, told ADWEEK.

Strong beauty growth continues

Last year, dollar sales of U.S. prestige beauty products climbed 14% to $31.7 billion, according to market research firm Circana. The mass market beauty industry also grew by 6%.

Larissa Jensen, a global beauty industry advisor at Circana, noted that despite the category’s strength, brands shouldn’t get comfortable.

“Consumers continue to cope with economic pressures, and being in tune with their shifting mindset is a must,” Jensen said in a statement. “Flexibility, creative thinking and effectively harnessing high consumer engagement are all part of the winning formula to drive continued growth.”

Finding success on TikTok Shop

Over its first seven months, shoppers bought an average of 2.5 times on TikTok Shop, according to the report from Dash Hudson and NielsenIQ, demonstrating that shoppers are coming back to the platform after their first purchase.

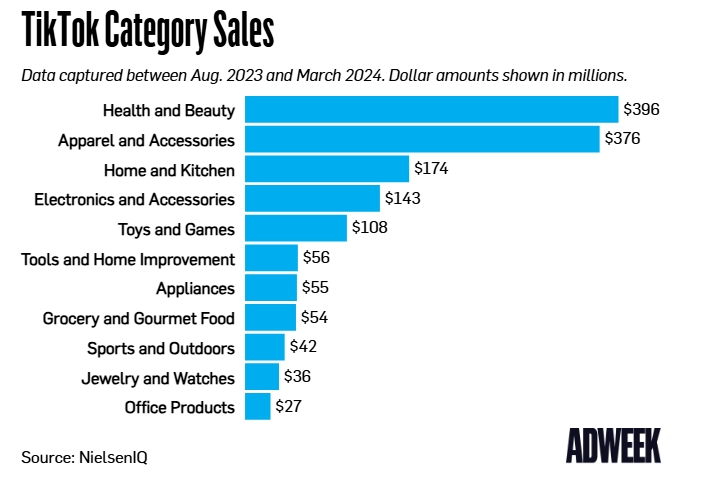

Health and beauty continues to outperform all other categories in terms of both brand follower growth and category sales, but apparel and accessories aren’t far behind.

Still, it’s not a perfect fit for every brand. TikTok controls the discounting on its ecommerce platform, and while that trade-off often makes sense for digital-first or challenger brands, more traditional brands have been hesitant to cede that control.

Companies like GuruNanda, Lattafa, MySmile, Tarte Cosmetics and VeyesBeauty have seen significant growth on TikTok Shop despite those discounts. They do so by tapping into trending topics and working with creators well-versed in what works for their audiences.

For Tarte, video views correlated with sales between October 2023 and February 2024, suggesting that more engagement leads to better performance within Shop, according to the report. NielsenIQ declined to disclose brand-level sales numbers with ADWEEK.

“It all comes back to the quality of content that’s pushing people to purchase those products,” Mayo said. “It really is a mix of brands that you would know from other places, as well as some new-to-the-world brands that are making this their platform of choice and finding success in doing that.”

文章来源:adweek

TKFFF公众号

扫码关注领【TK运营地图】

TKFFF合作,请扫码联系!

闽公网安备35021102002035号

闽公网安备35021102002035号